Comprehensive Accounting Expertise from SBA CPA

Smooth accounting workflow management is crucial to a successful business. We will address your accounting/bookkeeping needs in a timely manner, so the true financial state of your business is clear at all times.

SBA CPA experts will evaluate your current systems and suggest improvements. This means simplified expense and time tracking, plus timely and accurate financial data.

Improved Cash Flow Management

Cash flow shortages are the number-one reason why businesses fail. While they're not always completely avoidable, cash flow reporting and forecasting will help you get a better handle on the free cash flow that will be in your business at all times. You'll be able to better predict slow periods and new expenses (such as new hires) that can lead to shortages. With this knowledge, SBA CPA will work with you to devise the best strategies for avoiding and overcoming cash flow shortages.

Accounts Receivable Management

SBA CPA will make it more convenient for your clients to pay you by establishing a variety of systems, including electronic, for accepting payments. This will also result in you getting paid more quickly, reducing outstanding sales and closing your company's cash flow gap. We'll also help you track receivables and set up systems for collections if necessary.

Accounts Payable Management

SBA CPA helps you manage your accounts payable by establishing highly efficient systems for checks, balances, approvals, and payment remittance. In addition, we'll help you establish the most cost-effective schedules for payments to make the most of your company's cash on hand, while also taking advantage of early payment discounts.

Payroll Services from SBA CPA – Processes & Deliverables

Paying your employees on-time and accurately is one of the most important accounting functions within your business. An accurate and timely payroll process keeps your employees positive and productive. SBA CPA’s sound payroll processes not only keep employees happy, but they also keep the Internal Revenue Service off your back. In addition to paying your employees, we’ll manage the facilitation of tax withholding from employees and the filing of payroll taxes on behalf of your business.

SBA CPA is fully equipped to integrate our services with your company's payroll schedule, compensation structure, and benefit plans.

First, we'll gather all the necessary information from your company, such as employee information, benefit protocols, pay rates and salaries, and time sheets. Then, we process payroll on your schedule, whether that be weekly, bi-weekly, or monthly.

SBA CPA will calculate each employee's pay for the time period at hand and also calculate the necessary tax withholdings and other deductions such as insurance or 401(k) contributions. We will also ensure you remain compliant with accurately calculated and filed payroll taxes, Medicare, and social security payments.

We will handle the delivery of your payroll however you and/or your employees prefer (i.e. printed checks, payroll cards, or direct deposit).

In addition to processing payroll, we'll provide you with a complete payroll report each period to keep tabs on your human capital costs, such as overtime payouts, benefit use, and more.

Improve Your Human Capital Management

SBA CPA's professional payroll processing and management services will create new strategies for motivating, engaging your employees, and increasing employee participation in your benefits programs.

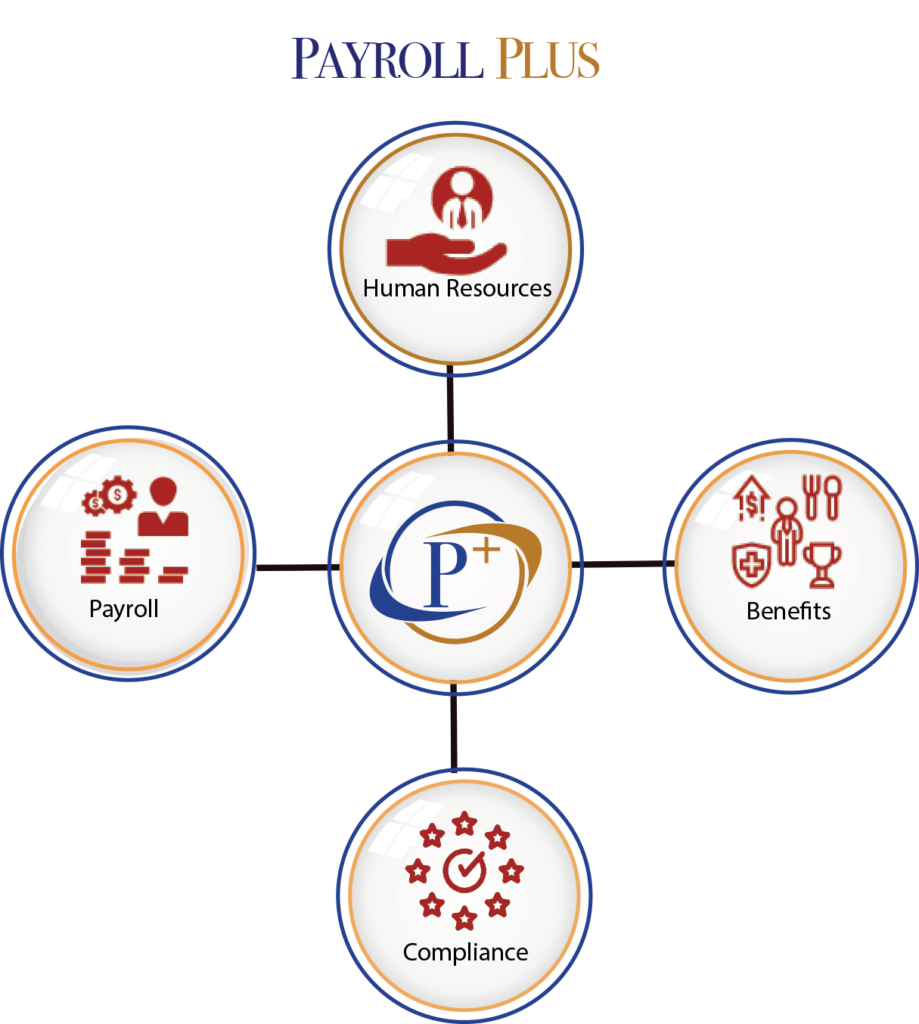

Payroll Plus HR Solutions

We offer human resources services for clients concerned by the impact of new legislation and compliance issues.

Human Resources

Today’s employers need the input of experienced HR professionals in order to maximize your investment in your employees

Employee Benefits

Employee benefits are more critical than ever in building employee retention and costs of providing employee benefits continue to increase. Our Payroll Plus benefit experts will provide benefits advice that can improve or maintain your benefits packages for employees while keeping your costs at the best rates possible.

Compliance

Keeping track of employee regulatory requirements are a heavy burden on employers. Rules and regulations for both existing employees and new hires are continually being changed across many business categories. Our HR team can keep you up to date on the latest requirements and offer solutions to ensure compliance.

With SBA CPA’s accounting services, you’ll be able to focus your time on running and improving your business.

Our small business accounting professionals will guide you to proven and more effective accounting processes and procedures.